Why Real Estate Investment in Germany makes sense

Investing in Real Estate is an attractive way to build wealth and minimize your tax burden

Property is tax-free after 10 years

If you rent out the property and sell it after 10 years, you don't pay tax on the capital gains. This makes real estate attractive for long-term investors, especially compared to ETFs.

Very generous tax write-offs

You can deduct common costs such as interest, land registry, notary fees, and property transfer tax related to your property investment as well as depreciation. This lowers your taxable income.

Borrow up to 100% with KFW subsidies

German banks allow you to borrow up to 100% of the property value and offer KfW loans with lower interest rates and more favorable repayment terms. This makes real estate investment properties very attractive for property investors.

Hassle-free tenant and property management

Tenant search and property management is handled without your involvement, so you don’t need to invest time and effort in it.

How we help you buy an investment property

We simplify your investment journey with smart, hands-off solutions designed to grow your wealth and secure your future.

We find and vet attractive projects for you

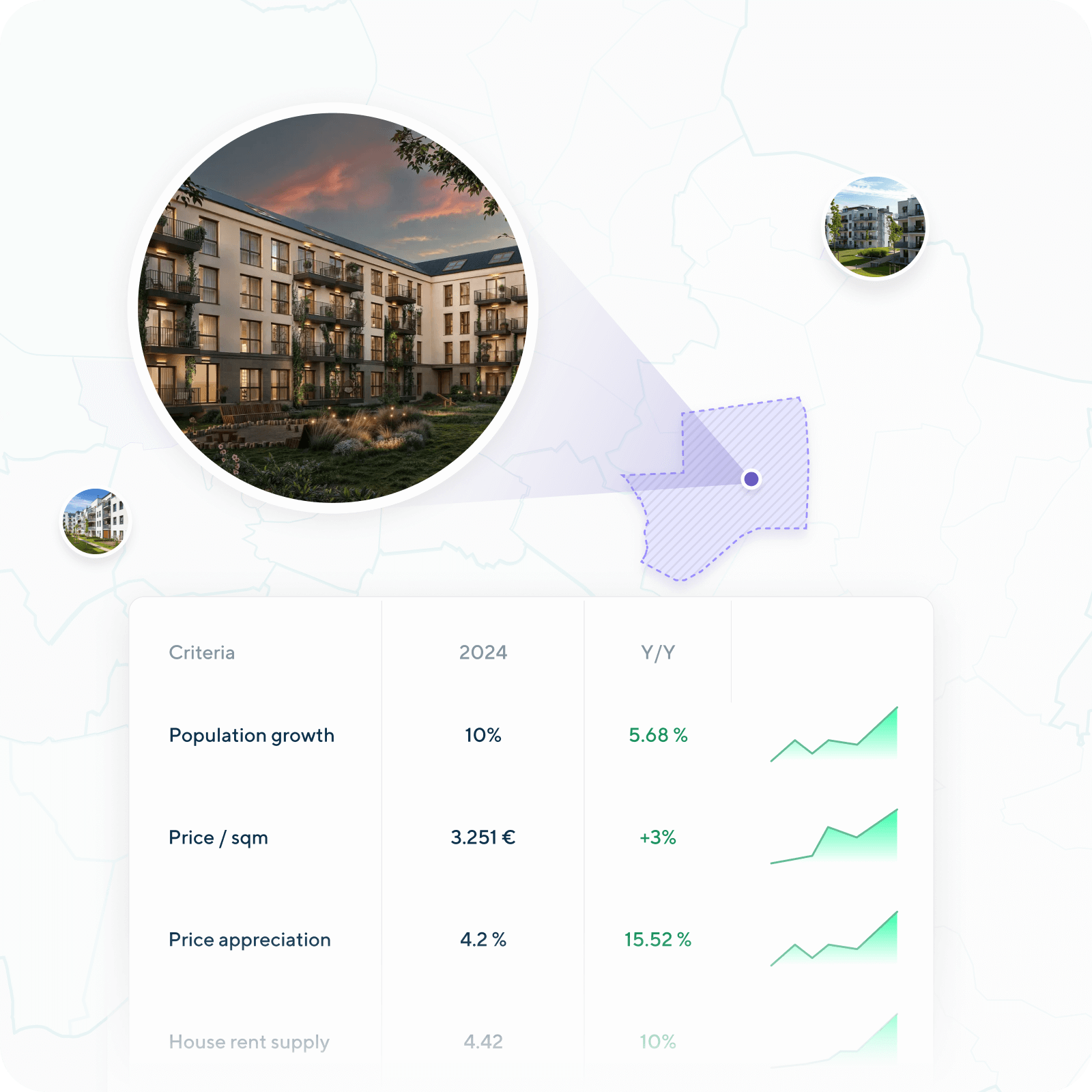

We review pricing and rentability in location

Consult you on investment strategy and preferences

We find the optimal financing options from 750+ lenders

We help streamline tenant and property management

Some of our QNG+ projects in Germany

We’re constantly seeking the best investment opportunities across Germany. Get in touch to discover our full list of projects in Leipzig, Dresden, Berlin, and Brandenburg.

Elstal Living

Elstal, Brandenburg

Mühlendorfer

Teltow, Berlin

Real Estate Investment Calculator in Germany

Understand how much wealth you can gain from investment properties with tax refund

What is your gross annual income?

What is your gross annual income?

What is the property price?

How much savings can you use?

Monthly Cashflow

Assumptions

i

| Over 10Y | Over 15Y | Over 30Y |

|---|---|---|---|

Appreciation

i

| 0,00 € | 0,00 € | 0,00 € |

Tax refund

i

| 0,00 € | 0,00 € | 0,00 € |

Operational profit

i

| 0,00 € | 0,00 € | 0,00 € |

Total profit

i

| 0,00 € | 0,00 € | 0,00 € |

Return on Equity

i

| 0,00 % | 0,00 % | 0,00 % |

What is your gross annual income?

What is your gross annual income?

What is the property price?

How much savings can you use?

Monthly Cashflow

Details explained

Buy an investment property in Germany

Benefit from new tax incentives to lower your tax burden and maximize your real estate investment returns.